Solutions / Lacima Analytics / Market Risk

Earnings-at-Risk (EaR)

Confidently calculate your Earnings-at-Risk (EaR), Gross Margin-at-Risk (GMaR), or Profit-at-Risk (PaR).

Your Earnings-at-Risk (EaR) Questions

How do I calculate EaR on a portfolio comprising both physical assets and financial contracts?

How do I calculate a single EaR projection across multiple deal/risk systems, regions, books and assets?

How can I develop an accurate ‘at-risk’ cashflow picture to inform my risk mitigation strategy decisions?

How can I model distributions of revenue or earnings uncertainty?

The inherent volatility of generation, or other physical assets and their markets, characterising the uncertainty of current and potential future earnings is extremely challenging. However, cashflow-based ‘at-risk’ metrics are essential for informing decision-making in energy and commodity businesses, particularly for those holding physical assets and the long-term structured financial trades that often back them. Leadership teams need to know the Earnings-at-Risk/Gross Margin-at-Risk of their asset portfolio, and how they may change over time, to ensure sufficient cashflow to meet operational needs, service debt repayments, pay dividends to shareholders, and fund growth.

Accurately calculating cashflows is uniquely challenging for energy and commodity assets due to their physical characteristics, operational considerations, market uncertainties, and the complexity of financial contracts. However, most ETRMs either don’t generate cashflow distributions, or don’t produce them to the standard required by executive leadership teams. This is where Lacima Analytics stands apart.

Our Earnings-at-Risk (EaR) Solution

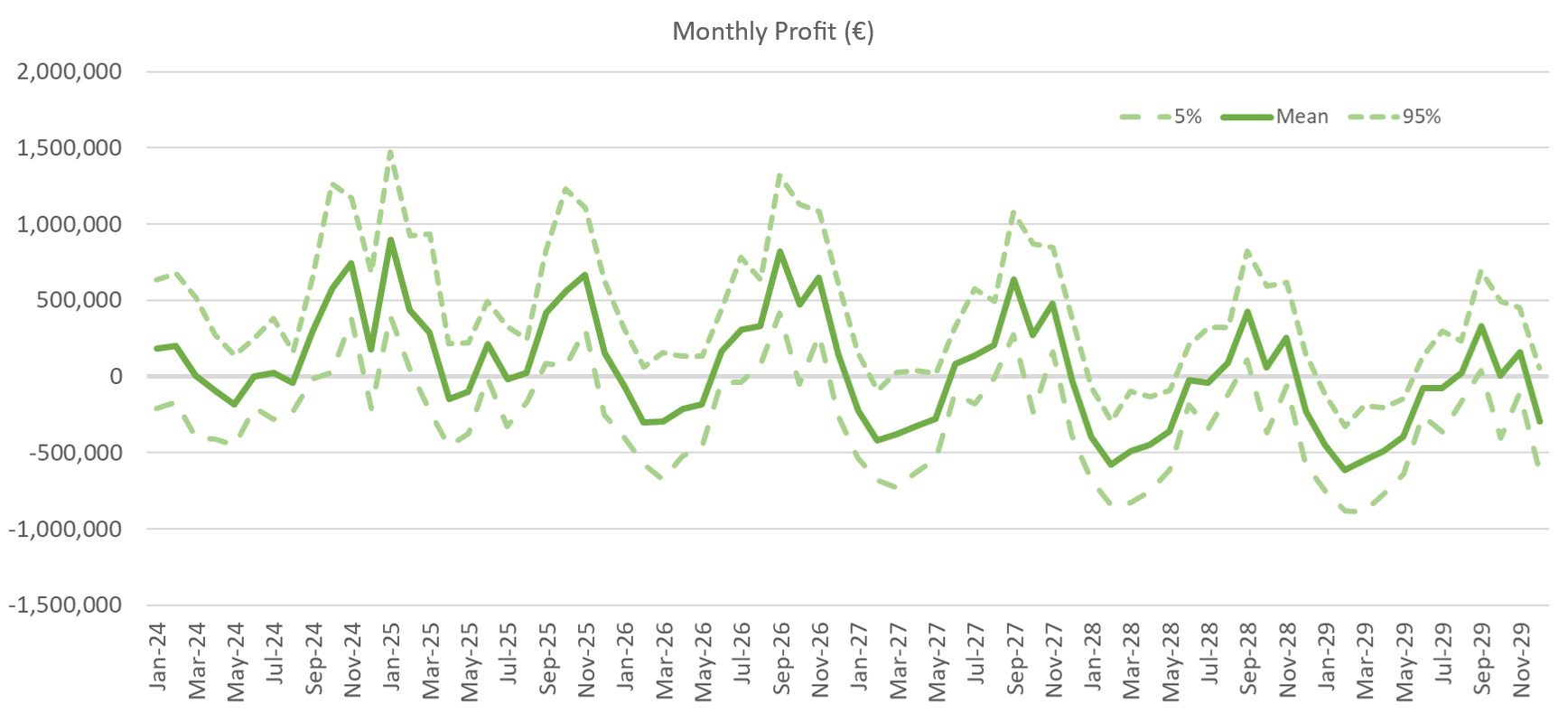

Calculate and manage your cashflow-based risk metrics including Earnings-at-Risk/Gross Margin-at-Risk/Revenue-at-Risk and Profit-at-Risk. Aggregate information across physical assets, structured trades and standard financial contracts to generate consolidated, accurate cashflow distributions for your business.

Designed specifically for energy and commodity players, Lacima’s flexible, input-agnostic architecture ensures compatibility with any energy or commodity asset contract you may hold.

Define and manage your risk tolerances with Lacima’s optional ‘Limits and Breaches’ module. Set limits on Cashflow-at-Risk, value and other key metrics such as asset, geography, portfolio, and book to automatically receive notifications when approaching, reaching, or breaching set limits.

The Earnings-at-Risk (EaR) Features

- Manage cashflow-based metrics

Track key metrics like EaR, GMaR, RaR, and PaR for better risk and profitability insights. - Compatible with any asset or contract type

Supports physical assets, structured trades, and financial contracts across diverse energy types including thermal, hydro, solar and wind power plants, battery storage, gas storage facilities, virtual storage, GSAs, PPAs, futures, swaps and options. - Consolidated cashflow projections

Aggregate cashflows across portfolios, business units, regions and systems for consolidated risk analysis. - Comprehensive cashflow projections

Generate detailed cashflow forecasts for asset operations or financial contracts throughout the entire life of the asset or contract. - View cashflows in different time horizons

Analyse cashflows across time horizons to assist with short and long-term planning and investment decisions. - Asset-specific precision

Account for the unique operational factors of different energy assets for more accurate projections. - Multi-dimensional views

View cashflows by different categories including revenues, costs, regions, or asset classes. - Granular insights and reporting

Drill down and view cashflow through specific lenses including revenue, cost, region, or asset class to identify individual risk hotspots. - Hedge strategy evaluation

Compare cashflows with and without hedges to assess their effectiveness. - Custom forecasts

Input your own price and volume forecasts for tailored cashflow metrics.

Related Solutions

Lacima Analytics > VaR

Easily and accurately determine Mark-to-Market value, Value-at-Risk, Greeks and position of any asset or financial contract type with a range of industry-leading valuation models.

Lacima Analytics > PFE

Calculate PFE to individual counterparties over the full duration of a deal. Generate thousands of forward curves to model potential Mark-to-Market values with a powerful simulation engine.