Quick Links:

A Step-by-Step Guide to Valuation and Risk with Lacima Trader

Japan’s electricity market is now one of the most active in Asia. According to the European Energy Exchange (EEX), traded volumes quadrupled in 2024, reaching 72.9 TWh – driven by record liquidity and the launch of new derivatives such as the EEX Japan Power Monthly Option. As this market matures, energy traders face increasing pressure to make data-driven decisions grounded in advanced valuation and risk analysis techniques.

This case study provides a practical guide to assessing value and managing risk for Japanese power derivatives. We walk through four essential steps using Lacima Trader: forward curve construction, simulation, option valuation, and portfolio risk analysis. Each step is explained in plain terms to help energy traders – from novice to experienced – understand the logic behind the analysis and the value each adds.

Step 1: Constructing a Shaped Forward Curve

You can’t value or manage risk without a reliable forward curve.

– Jivan Drungilas, Quantitative Analyst

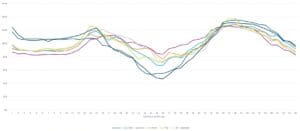

A forward curve is a forecast of future prices. It’s the foundation for valuing power contracts and calculating exposure. In Japan’s power market – where trading spans different time periods and granularity levels – a shaped forward curve reflects the unique seasonal and intraday dynamics of supply and demand.

How to build a forward curve:

- Input available futures and forward contract prices (e.g. monthly, quarterly)

- Define market time granularity: daily or half-hourly

- Set parameters for peak and off-peak periods

- Infer missing prices based on average relationships between periods

For example, if a quarterly price is quoted but one month within that quarter lacks a specific quote, the missing value can be inferred so that the monthly prices average to the quoted quarter.

To make the curve realistic, apply profiling (also known as shaping) – an adjustment using historical spot prices to reflect how prices change throughout the day and across different days of the week. In Japan, this often means capturing lower weekend demand and morning-evening peaks.

Why it matters:

- Enables precise Mark-to-Market (MtM) valuation of power contracts

- Reflects trading granularity required for Asian-style options

- Provides the price structure needed for simulations and scenario testing

Figure 1. Base Forward Curve

Figure 2. Profiled Forward Curve

Step 2: Simulating Power Prices

Simulation bridges the gap between market structure and real-world trading outcomes.

– Jivan Drungilas, Quantitative Analyst

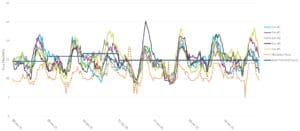

Simulation helps traders understand uncertainty by generating many possible future price paths. This is especially important in the Japanese market where prices are influenced by weather, demand, and fuel input volatility.

How simulation works:

- Start with your profiled forward curve

- Use historical spot prices to estimate key model parameters:

- Volatility: How much prices vary

- Mean reversion: The tendency for prices to return to expected levels

- Jump diffusion: Sudden, extreme price changes

- Run Monte Carlo simulations at half-hour granularity

Simulations can be enhanced by separating volatility by season and time of day – helping match market reality.

Why it matters:

- Reveals the full distribution of possible future outcomes – not just averages

- Enables you to calculate risk metrics like Value-at-Risk (VaR)

- Supports stress testing and capital planning for market shocks

Figure 3. Price simulations with historical and forward curve forecast comparison

Step 3: Valuing Japanese Power Options

You can’t manage what you can’t value. Option pricing gives you the data you need to act.

– Jivan Drungilas, Quantitative Analyst

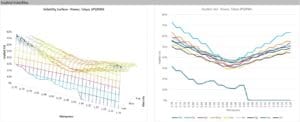

Japan’s market now supports Asian-style options, where payoffs depend on average prices over a period. Accurately pricing these products is critical for trading and hedging.

How to value power options:

- Enter inputs: Forward prices, option strike, start/end dates, option type (call/put)

- Generate either:

- Premium: The fair price of the option

- Implied volatility: The market’s estimate of future price movement

Create an implied volatility surface, a 3D map showing how volatility varies by strike (moneyness) and expiry. This helps you see the shape of risk across your positions.

Why it matters:

- Ensures option pricing is consistent with market conditions

- Helps identify mispriced contracts

- Supports risk sensitivity analytics (via Greeks: Delta, Gamma, Vega & Theta) for better hedging

Figure 4. 2D and 3D Implied Volatility Surface

Step 4: Portfolio Valuation and Risk Analysis

The power of analytics is not in the individual tools, but in how they come together to guide decisions.

– Jivan Drungilas, Quantitative Analyst

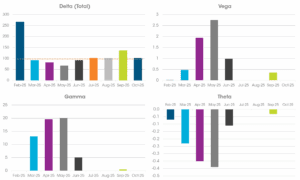

Energy portfolios are typically composed of many instruments like forwards, options, structured spreads. Managing the full risk exposure requires visibility across all components.

Example portfolio:

- A strip of forwards from February to October

- Call options at multiple strikes for February

- Put options for March-June

- A bull call spread in September (long one call, short another)

How to analyse it:

- Determine MtM value for each position

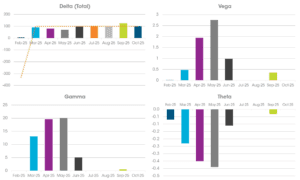

- Calculate Greeks to see risk exposure:

- Delta: Exposure to price direction

- Gamma: Exposure to volatility of Delta

- Vega: Exposure to volatility changes

- Theta: Exposure to time decay (how option value erodes as expiry approaches)

- Run scenarios (e.g. reversing a forward position) to see impact on risk profile

Why it matters:

- Enables alignment across trading, finance and risk teams

- Improves hedge design and capital efficiency

- Highlights periods of vulnerability (e.g. summer peaks)

Figure 5. Unhedged Monthly Greek Exposure

Figure 6. Delta Hedged Monthly Greek Exposure

Conclusion: Practical Tools for a Complex Market

Japan’s power market is now a globally traded, liquid and fast-evolving market. Traders operating here need advanced tools to stay ahead.

Lacima Trader enables:

- Fast, reliable forward curve construction

- High-resolution price simulations

- Transparent option pricing with volatility surfaces

- Scenario-based portfolio valuation and Greek analysis

The easy-to-use workflows within Lacima Trader turn complexity into clarity, enabling better decisions across the trade lifecycle.

Ready to take the next step?

If you have any questions about this content or how Lacima Trader can support your valuation and risk strategies, reach out to the Lacima team.