Solutions / Lacima Analytics / Valuation

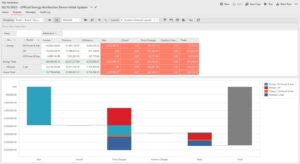

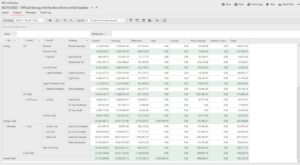

P&L Attribution

Understand how and why your P&L is changing over time.

Your P&L Attribution Questions

How do I calculate and explain changes in my portfolio over time?

Is it possible to attribute P&L into each of its different elements to understand what’s driving my P&L changes?

How do I understand and explain how recent portfolio changes have affected value?

Can I view my P&L under different value drivers (Greeks) such as price and portfolio evolution?

Can I consolidate Consolidating positions from multiple trading and risk systems, markets, and assets into a single P&L?

How do I breakdown portfolio evolution of my P&L changes by new, closed and changed positions and time decay?

Our P&L Attribution Solution

Attribute your Profit and Loss (P&L) by breaking down your portfolio into discreet components to understand and explain where your value is coming from and how it’s changing over time.

Compare your portfolio over any time range and assess the sensitivity of that value under Delta, Gamma and Theta Greeks.

Customise reporting with a range of flexible components and views available when producing P&L attribution. Automate P&L reporting thanks to flexible data connections and scheduled reporting functions.

The P&L Attribution Features

- Identify value drivers

Identify and isolate individual portfolio attributes to evaluate their specific effect on P&L. - Deeper insights with granular reporting

Drill down and report P&L under different criteria including commodity, region, market, desk, strategy, trader, risk factor, or trade. - P&L change tracking

Compare previous and current metrics to pinpoint drivers of P&L fluctuations. - P&L consolidation

Combine P&L data from multiple deal capture and risk systems, asset classes, regions and business units for a single, comprehensive view of P&L. - Flexible valuation metrics

Select from a diverse range of valuation metrics including Mark-to-Market, Exposure, Delta, Gamma, and their contract currency variants.

Related Solutions

Lacima Analytics > Valuation (MtM)

Produce accurate Mark-to-Market valuations that account for the intricate features of energy and commodity market instruments.

Lacima Analytics > VaR

Easily and accurately determine Mark-to-Market value, Value-at-Risk, Greeks and position of any asset or financial contract type with a range of industry-leading valuation models.