Solutions / Lacima Trader

Swing

Structure, value, hedge, and analyse swing contracts to maximise profit.

Your Swing Questions

How can I evaluate and compare performance under different models including intrinsic and rolling intrinsic?

How can I determine when to exercise swing options to maximise profitability?

What are the intrinsic and extrinsic values of a swing contract?

How can I determine the optimal value and exercise of a swing contract and how it may change over time?

How do I assess the impact of shocks and scenarios on the value of my swing contract?

How do I identify the hedges required to risk manage my swing contract?

How can I identify the actions needed to drive trading and asset management decisions?

Our Solution: Swing

Features: Swing

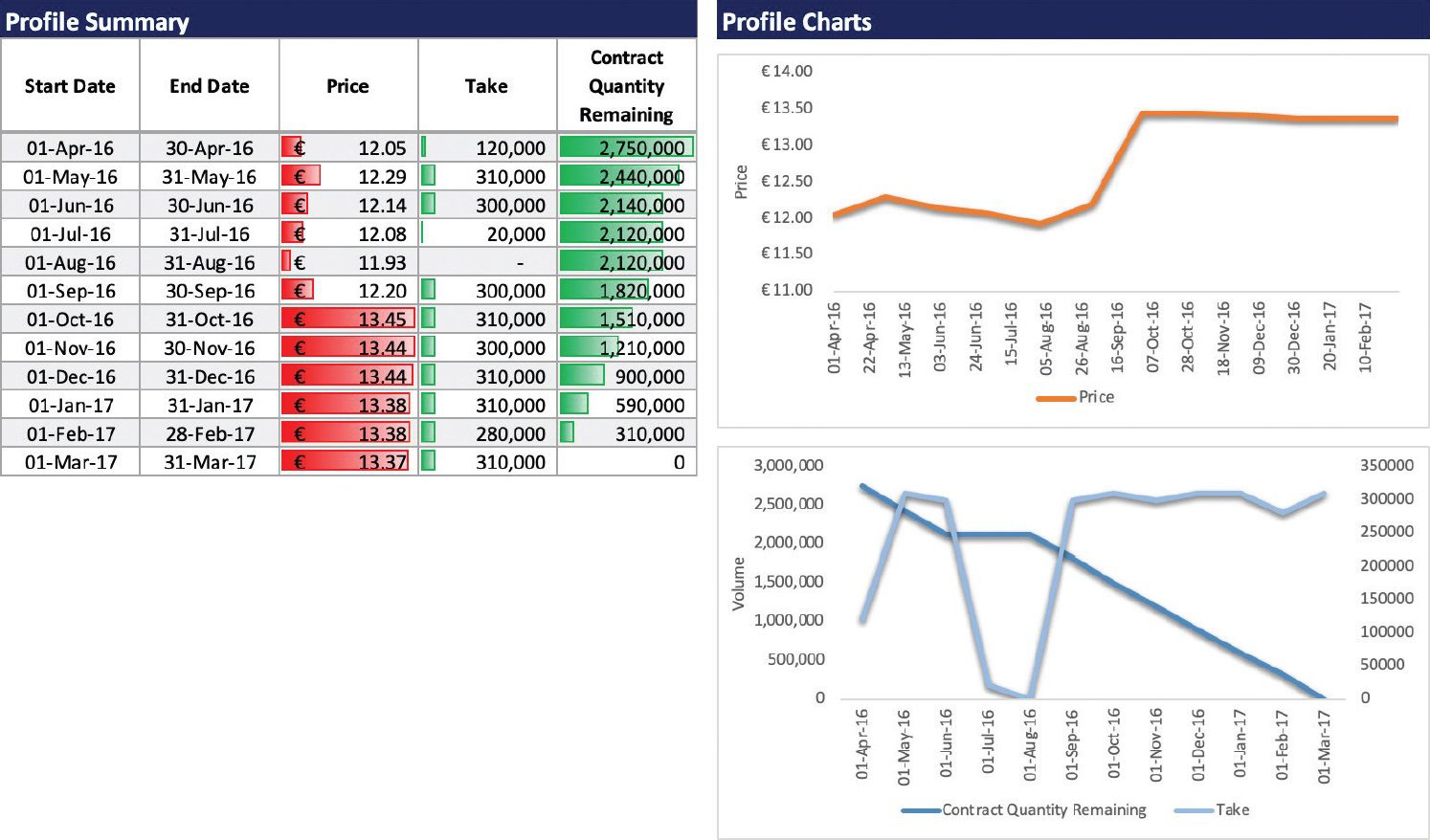

- User-specified inputs support the unique needs of swing contracts such as TCQ, DCQ, indexation, minimum bill, and volume-to-date

- Range of available valuation methods including intrinsic, rolling intrinsic and semi-analytical method

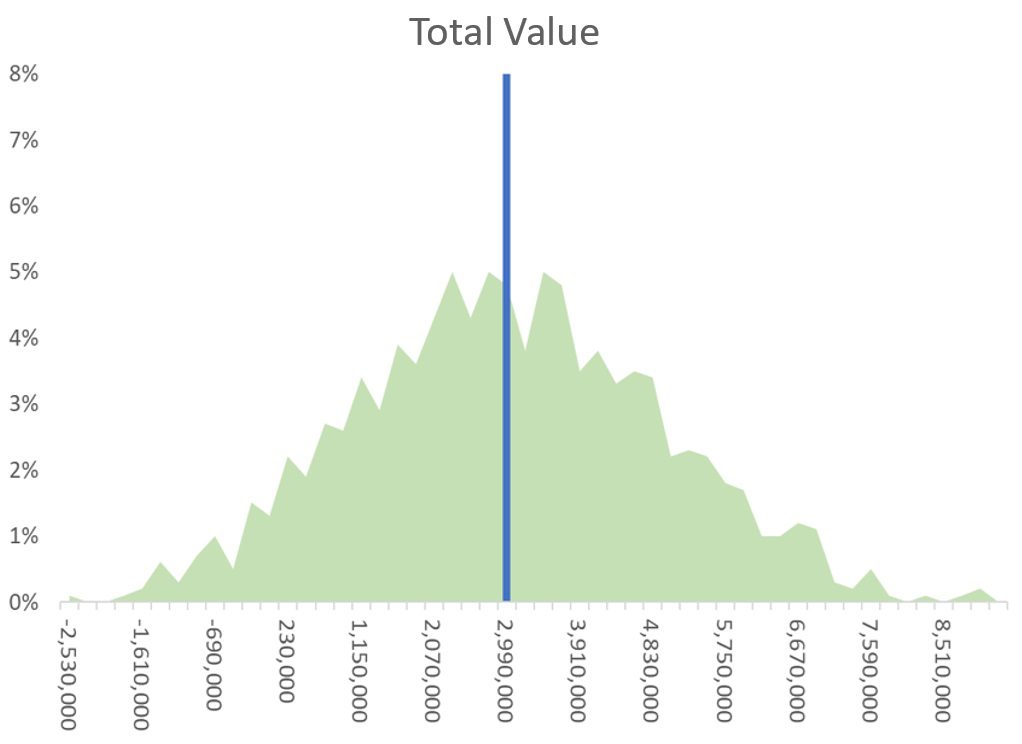

- Calculate intrinsic and extrinsic value and the full distribution of value

- Detailed output tables of optimal daily take and rebalancing trades

- Decompose P&L into physical and financial value

- Full simulation of forward prices using a multi-factor model

- Evaluate strategies through time using historical data or user-defined forecasts

- Identify trades required to rebalance to optimal position for monetisation of trading strategies with the trade blotter

- Calculate daily decisions on optimal take volumes

- Flexible customisation through the familiar Excel interface

Related Solutions

Simulation

Generate simulations of spot and forward variables with an advanced Monte Carlo simulation engine for informed deal analysis and structuring.

Curve

Convert forward quotes into detailed arbitrage-free curves. Supports multiple levels of granularity including monthly, weekly, daily, hourly, and half-hourly.

Pricer

Produce and analyse positions, calculate values and risk sensitivities for a wide range of energy and commodity derivative instruments quickly and flexibly.

Storage

Structure, value and hedge gas storage assets and identify the trades required to rebalance a storage portfolio to maximise profit.